How to Value a Business

Home / Business Valuation / How to Value a Business

So you want to know what your business is worth?

The answer might not be as simple as you think.

Quick Valuation Process

- Recast financials to get EBITDA or Discretionary Earnings (DE)

- Look up Multiple of Earnings (MoE) in reference book

- Value = MoE x EBITDA

Shortcomings of the Quick Valuation Process

- Historical numbers might not be a good indicator of future performance.

- The subject business might be larger or smaller than the typical size used by the MoE

- It does not take into consideration specific qualities of the subject business.

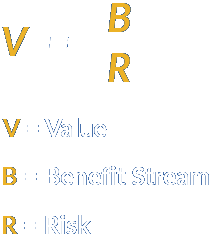

The Value Equation

V = B/R = (1/R) x EBITDA = MoE x EBITDA

Calculating Cash Flow

- EBITDA shows the pretax revenues of the business unencumbered.

- Used to more easily compare cash flows and calculate post transaction debt structure.

- A “Quality of Earnings” analysis by a CPA firm is a deeper dive into the current and predicted future cash flows of the business. Used by private equity and alternative lenders.

Components of Risk

- Cost of Capital: Lower capital costs equate to higher business valuations

- Revenue Size: As revenues increase, so does the multiple of earnings

- Industry: Risk vs reward factors vary from industry to industry

- Company-specific: There are many elements of a business that can have a significant impact on the company's value

Company Specific Elements

- Value Drivers: Elements of a business, or its environment, that helps sustain or increase future revenue streams.

- Risk Factors: Elements of a business, or its environment, that can negatively affect current or future earnings.

- Synergies: Those elements of a business that are missing which could drive earnings or reduce risk.

Final Analysis

- The quick valuation process will give you an idea of where the general market is.

- A deeper look will uncover both hidden value and risk, enabling a more comprehensive valuation.